Women in the boardroom, where do we stand?

An indicator investors monitor closely

Seen by most as a key proxy of good corporate governance, gender diversity at the board level enhances the ability to overcome challenges and enable decision-making groups to benefit from wider perspectives. Gender diversity has become a common indicator that asset managers around the world actively track and often choose to lift in their company engagements. Moreover, asset managers must report on board gender diversity, which is a so-called Principal Adverse Impact (PAI) indicator under the Sustainable Finance Disclosures Regulation (SFDR). It is fair to say that progress is being made, but gender diversity still remains very low in most jurisdictions- except where specific quota requirements exist.

It is fair to say that progress is being made, but gender diversity still remains very low in most jurisdictions - except where specific quota requirements exist.

The MSCI Women on Boards and Beyond report, published annually since 2009, is an insightful source. MSCI examined the correlation between female board representation and financial performance, finding that MSCI ACWI Index constituents with at least 30% female directors achieved 18.9% higher cumulative returns than those without, between 2019 and 2024.

Still no “womentum”, especially in emerging markets

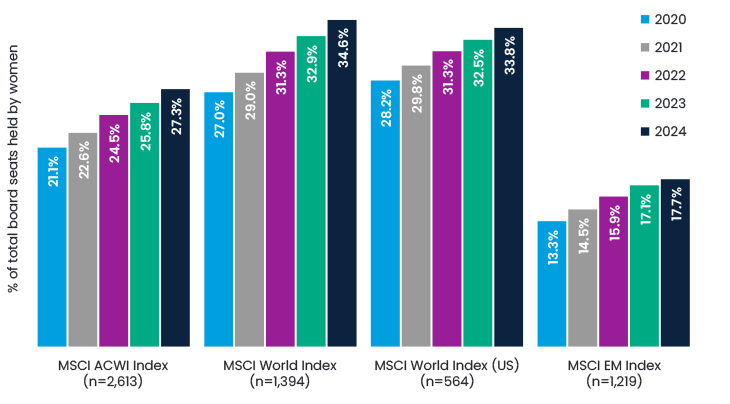

According to the MSCI report, in 2024, women held only 27.3% of board seats at publicly listed large- and mid-cap companies globally (MSCI ACWI Index), and 46.2% of companies had at least 30% female directors. Emerging market (EM) companies, however, are performing worse, with just 17.7% of board seats held by women and progress remaining sluggish. Alarmingly, 16.1% of MSCI EM index constituents have all-male boards - a stark contrast to developed markets. Meanwhile, 16.9% of EM companies have at least 30% female directors.

Figure 1. Overall percentage of board seats held by women, by index constituents (2020-2024)

As for chairwomen, only 10.5% of developed market (DM) companies have a female chair compared to just 7.4% of EM companies. The MSCI report provides valuable data on gender diversity for the CEO and CFO roles, board committees, tenure and overboarding. A particularly striking statistic is that only 2 out of 566 US companies in the MSCI ACWI Index have all-male boards- while in China it is 99 out of 512 companies. Chairman Mao’s famous quote, “Women hold up half the sky," does not seem to apply to China’s boardrooms.

Beyond the index constituents and the largest companies

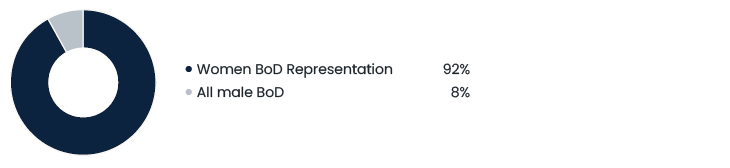

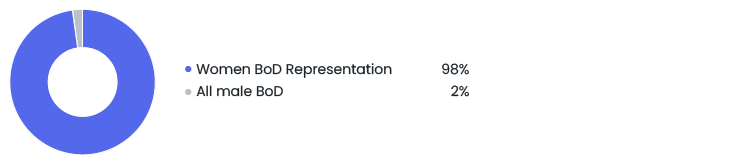

East Capital Group’s portfolio holdings show, as can be expected, similar gender diversity levels when it comes to DMs vs EMs. In Espiria (whose strategies invest in global equities, Nordic equities and Nordic fixed income), we have 9 holdings which currently have no woman on the board, representing approximately 2% of total AUM and 3% of all companies in our Espiria portfolio. In East Capital (specialising in emerging and frontier market equities), 18 companies have all-male boards, while 151 companies include at least one woman on the board—representing approximately 8% and 89% of total covered AUM respectively, and approximately 12% of all companies in our East Capital portfolio.

These numbers can be compared to the broader market, where 16.1% of companies in the MSCI Emerging Markets Index had no women on their boards, as of 2024 - down from 18.6% in 2023. In developed markets, the presence of all-male boards has become almost negligible, with only 2 out of 1,394 companies in the MSCI Developed Markets universe lacking female board representation. Globally, across all markets, 14% of major companies still have all-male boards, showing that while progress has been made, there is still work to be done to achieve gender balance at the board level.

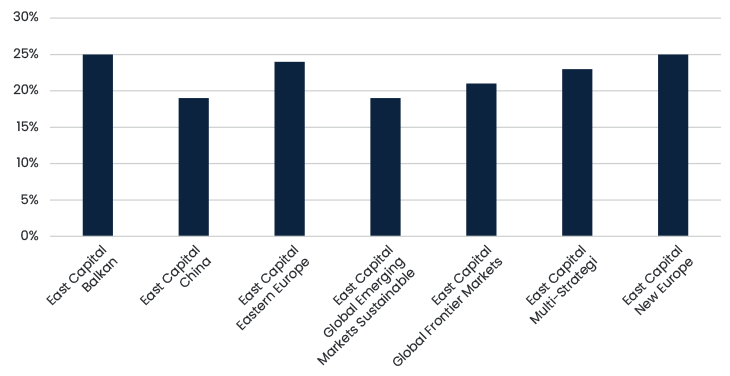

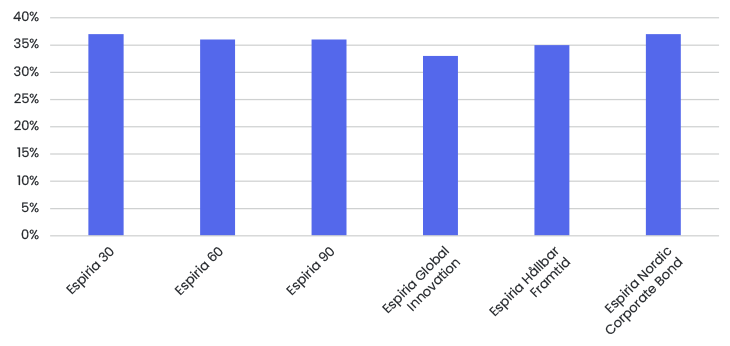

The boards of directors of our Espiria portfolio companies consist, on average, of 37% women, whereas in East Capital, the average is 22%. It is worth lifting India, one of the largest emerging markets, who has mandated that companies must have at least one woman on the board. This improves the overall numbers for EMs when compared to say, China. However, we do note that in some cases female directors are relatives of the promoter. While this does not necessarily indicate poor governance, neither does it indicate that that the female presence contributes to the diverse perspective that underpins strong corporate governance.

Figure 2. East Capital - Average % Women on BoD

Figure 3. East Capital - % AUM Representation of Women in BoD

Figure 4. Espiria - Average % Women on BoD (1)

Figure 5. Espiria - % AUM Representation of Women in BoD (1)

Gender Action

At East Capital Group we have always been conscious of gender diversity at the board and management levels, analysing our holdings and leveraging our proprietary ESG tools. A lack of sufficient gender diversity typically leads us to vote against director nominations and prompts us to engage with companies on this issue. In 2024, we conducted 18 gender-specific engagements with 8 different companies and voted against board nominations in 29 companies.

We recently decided to join an initiative through the PRI collaboration platform, which aims to promote dialogue on gender diversity with companies within our portfolios. Meanwhile, in the US, the new administration has moved to dismantle Diversity, Equity and Inclusion (DEI) programs, arguing they are “discriminatory and wasteful.” Despite this shift, we remain committed to prioritising gender diversity in our dialogues and engagements with our holdings, believing it to be both important and impactful.

(1) Researched by our data providers, covering approximately 88-89% out of total Assets under Management (AUM) or 288 out of approximately 330 companies