Our story

Working for positive change since 1997

From Emerging and Frontier Markets to the global arena - East Capital Group is working for positive change.

If 27 years ago we were identifying trends connected to the transition from planned economies to consumer-driven markets, today we are working with and for the transition to a sustainable world. And today, we’re global investors with an active and long-term ownership in hundreds of companies around the globe.

With a range of strategies capturing investment opportunities in both emerging and developed markets, East Capital Group is well-equipped to continue pioneering and offering exciting investment solutions today, and in the years ahead.

1997

East Capital is founded

East Capital is founded by Karine Hirn, Kestutis Sasnauskas and Peter Elam Håkansson. Based on sound Nordic values, we set out to be a long-term, active, and responsible owner. Dialogue, voting and engagement to impact portfolio companies have been important parts of our investment process ever since.

When East Capital Group began operations in 1997, it was very clear to us that we needed to be out from behind our desks meeting the actual companies in real life, both before we would invest, and when we were already shareholders.

We launch our first funds - the Russia and the Baltic fund.

1998

The early days

Early on we learned that not only do you have to ask the right person the right question, but you have to do it in the right place, at the right time. For example, we learned that winter was the best time to meet companies in Eastern Europe. Why? If the offices were not heated, the company had no cash to pay their electricity bill as they were probably getting paid through barter trade. It was a simple but efficient analysis. We held a lot of meetings in cold conference rooms and avoided some poor investments. Back home, we would read research equity reports and couldn’t believe investment banks were praising the same companies whose chilly meeting rooms we had just visited.

2002

Expanding our investment universe

Our investment universe is expanded to cover all Eastern European countries. We launched our first East Capital Eastern Europe fund. The first annual letters are sent to all portfolio companies, detailing our expectations as owners.

2004

East Capital Awards and East Capital Summit

Our first annual East Capital Awards take place, to reward and inspire the progress of outstanding companies in East Capital’s portfolio.

We organise the first East Capital Summit, inviting both clients and portfolio companies. Throughout the years we have often organised investors trips and summits, a platform for investors from all over the world to meet and to get to better understand emerging and frontier markets.

2005

East Capital Real Estate

Launching East Capital Real Estate operations and our first Baltic Property Fund.

2006

New asset class and opening up in Asia

Launch of East Capital Financial Institutions Fund, at the time the largest private equity fund dedicated to Russia and the CIS. We open our office in Hong Kong, to market our Eastern European strategies to Asian investors. This is an important step for us to establish ourselves in a fast-growing part of the world.

2010

Investing in Asia

Asia becomes part of our investment universe and we open a representative office in Shanghai.

2013

First fund manager from Northern Europe to receive a QFII license

We are the first fund manager from Northern Europe to be awarded a so-called QFII license, which gives us the right to trade domestic Chinese equities on Shanghai and Shenzhen stock exchanges. One year later our China fund is the first UCITS fund in the world to be granted the right to invest 100% through Stock-Connect into A-shares.

2014

East Capital Global Frontier Markets

Launch of East Capital Global Frontier Markets fund – adding frontier Africa, the Middle East and Latin America to the investment universe. We open an office in Dubai.

2015

Protecting minority investors

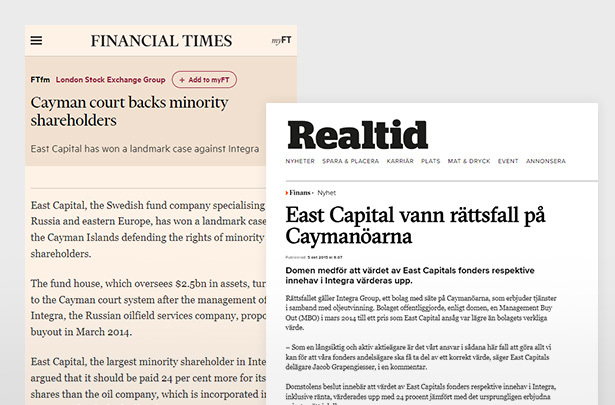

Integra, a landmark court case, puts East Capital Group on the map for protecting minority investors all over the world. East Capital successfully took legal action via the Cayman Islands Companies Law, which offers shareholders who disagree with the price offered in a merger an opportunity to dissent, and ultimately entails that the Cayman Islands Grand Court determines the fair value, should the parties fail to agree on a fair price between them.

2016

Proprietary ESG scorecard

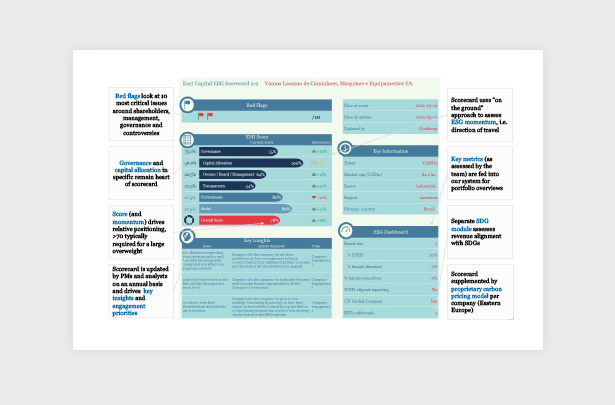

We developed a proprietary ESG scorecard to further integrate ESG into our investment process and to incorporate ESG-related risks and opportunities. This scorecard was updated in 2017 to include SDGs - the UN's Sustainable Development Goals. In 2022 we took another developmental step, adding new tools for other asset classes and a sustainability assessment tool. We were proud to see our work featured as a case study by the Principles for Responsible Investments (PRI).

2019

Adrigo, Espiria and launching our first sustainable fund

Adrigo Asset Management and its award-winning hedge fund Adrigo Small & Midcap becomes part of East Capital Group.

Espiria Asset Management with its Global and Nordic equities and fixed income strategies becomes part of East Capital Group.

We launch our first sustainable fund, East Capital Global Emerging Markets Sustainable.

2022 AND BEYOND

Always with an Explorer mindset...

We pour time and energy into researching and meeting new and existing investment opportunities, looking at sites and operations, and understanding what is happening in local markets, using proprietary, unbiased research. That way, we can make the best possible investment decisions for our clients.

...and being on the ground

Even though the world has changed in many ways in the past 25 years, East Capital Group still adheres to the same principle of having eyes and ears on the ground. Whether through East Capital’s Emerging and Frontier Markets strategies, Espiria’s global strategies or East Capital Real Estate funds in Central and Eastern Europe, it is the same principle that applies across all East Capital Group funds and asset classes.