Is there any green left in the White House?

2024 has been called an election year, with 48% of the world’s population going to the polls. With the most awaited of these elections now over, and the return of Donald Trump to the White House, attention has shifted to how his presidency will affect the critical sustainability challenges we face, especially in light of some loudly advertised statements made during his campaign. Trump has for instance vowed to increase the US production of fossil fuel by easing the permitting process for drilling on federal land and encouraging new natural gas pipelines and has said he will again pull the US out of the Paris Climate Accords. How should investors position themselves?

A climate denier at the head of the world’s largest petro-state

Not only did Trump win the election but the Congress and Senate will be dominated by the Republicans, making it easier for Trump to pass laws, and a potentially significant shift from President Joe Biden’s energy policies is expected. To be fair, Harris herself was not a climate champion either, and climate risks were barely mentioned during both candidates’ campaigns, despite 2024 confirmed as the warmest on record with extreme weather wreaking havoc also on American soil.

US oil production has jumped 24% over the last four years and the US is now producing 13.2 million barrels per day, more than any other country in history. It recently became the world's largest exporter of liquefied natural gas. Driven by the need for energy sovereignty in the wake of the aftermath of Russia's invasion of Ukraine, this increase occurred during Biden's tenure. But there is another significant trend shift which happened during Biden's tenure: renewable energy has moved out of its "alternative energy" niche, as the price of solar and wind power fell below the price of fossil fuel energy.

Figure 1. Oil Production (million barrels/day)

So far, Trump's nominees for key government positions which shape climate and energy policies do not bode well for our planet. They include the head of the Environmental Protection Agency (Lee Zeldin, who has promised to roll back regulations), the Secretary of the Department of the Interior, who oversees the issuance of leases for natural resources on federal land (Doug Burgum, who wants to cut red tape to ensure "American energy dominance"), and the Secretary of Energy (Chris Wright, CEO of the fracking company Liberty Energy).

Geopolitics

The US retreating from climate diplomacy could seriously undermine global action to cut fossil fuel reliance and potentially give other major emitters an “excuse” to scale back their own decarbonisation plans. For instance, many observers interpreted the decision by right-wing president Javier Milei to withdraw its delegation from the COP29 UN Climate Summit as a proof of his intention to strengthen ties with the US, aligning the country on Trump’s views of the Paris agreement.

Countries that no longer have a seat at the table lose the opportunity to shape global policies. That could be the reason why Trump does not pull the US out the Paris Agreement. But if he does, it has the potential of galvanizing other countries and other stakeholders such as corporations and states.

Another question mark is what kind of headwinds are faced by MDBs (Multilateral Development Banks) where the US is the largest shareholder, including the World Bank. They are a very important source of climate finance, and future commitments to such funding activity might be in doubt. Thankfully, there are other international funds such as the Green Climate Fund which are not dominated by the US.

However, analysts do worry that the protectionist “America First” new administration will bring new challenges in the form of very high tariffs on all Chinese goods including green products. These tariffs will moreover have an inflationary impact on the US economy, with an implication of a tightening of US interest rates in the future, which will be painful for debt-laden industries such as clean tech and renewable energy.

China is the leading force behind the solar capacity additions, and almost every other clean technology that exists today. If the US backtracks on its climate ambitions and Trump once again pulls back from the Paris Agreement, some argue that it will basically give China an even stronger lead in the climate race, while the US will no longer have a seat at the table to shape global policies. Every country on the planet, and not least the ones from the Global South (most of these are fossil fuel importers, providing them even more reasons to accelerate the transition to renewables), will deal with Chinese companies when it comes to procuring equipment or attracting investments related to clean technologies.

What is worth highlighting is that the US-China relationships, while expected to become volatile again, will not necessarily become worse. It is under Biden that the US has introduced hard tariffs on Chinese electric vehicles and plenty of other goods; as well as export and import restrictions. Trump has called climate change a “hoax”, but his primary objective is to restore US competitiveness, not to fight climate policies just because.

Onshoring, jobs and AI

One of Trump’s priorities, besides deregulation and immigration, is to cut taxes, for instance to reduce the corporate tax from today’s 21% to 15%. To do so, the Treasury needs to reduce expenses to compensate for lower fiscal revenues - the so-called budget reconciliation process, and find cuts that add up to USD 4.5 trillion. Many believe that the energy security and climate-friendly Inflation Reduction Act (IRA), signed into law by Biden in August 2022, and one of the largest investments ever made in the American economy, could be cancelled in part or totally. Trump himself has called it “the Green New Scam”.

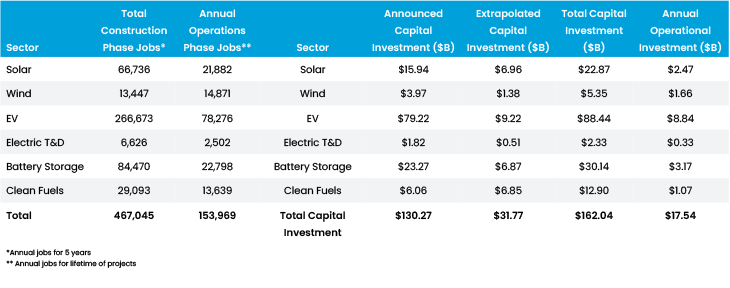

The IRA has been reshaping US industrial competitiveness by promoting domestic production of batteries, solar panels, and clean energy infrastructure as well as energy efficiency investments across the economy. In the first two years under IRA, there were announcements of USD 130 billion of investment and 467,000 jobs over the next 5 years (see Figure 2). Once the projects are built, Bank of America estimates that 150,000 new jobs will be created in operations (of which 78,000 will be in the EV value chain, which is also the largest sector in terms of capex). As roughly 80% of the money spent so far has flowed to Republican congressional districts and more than 50% of the announced projects and jobs are in red states, congressmen from these states will most likely fight to keep a large part of the IRA deals, which also would support the other priority of the new Trump administration, namely bringing industries back onshore, in order to create jobs and growth.

Figure 2. In the first two years under the IRA, businesses announced $130B in investments and 467k new jobs over the next 5 years. Clean energy investments and jobs created by those investments.

Within the power related sectors, some IRA-related benefits are expected to be repealed but not all. Spending that supports solar are likely to stay (ironically it is actually an industry which is profitable even without IRA credits), while green hydrogen and EV charging related spending are more likely to be cut. For the wind sector, the impact will be neutral as the US has not been a big market. Europe, for instance, is planning to add 3 times as much capacity in 2025. Regarding EVs, there is the Elon Musk factor to take into account but this is a wild card.

The power-hungry AI boom is another reason why other sources of carbon-free energy are expected to surge. There will be a new (not policy-driven) cycle surge for power demand, due to AI and hyperscalers such as Microsoft and Amazon who, to abide with their carbon reduction objectives, are compelled to buy green energy.

One sector almost certain to be boosted, is nuclear power. Carbon-free power is the solution to meet the unprecedented energy demand, through innovative solutions like SMR (Small Modular Reactors), upgrading of older facilities, extension of near end-of-life facilities and building of new capacity. Current plans are for the US to triple nuclear power capacity by 2050, by deploying an additional 200 gigawatts of nuclear energy capacity by mid-century with demand for the technology climbing, for around-the-clock sources of carbon-free power.

A Responsible investment world, shaken not stirred

The last years have shown strong headwinds for responsible investing in the US. ESG has become politicised and used in ideological debates, adding fuel to the fire of the woke and anti-woke movements, with a big focus on Diversity, Equity and Inclusion. All of this eventually created a backlash with detrimental consequences. The US legal system also differs substantially; anti-ESG regulations and mentions of anti-trust proved threatening for many managers who have left collective engagement initiatives such as Climate Action 100+ and NZAM (Net Zero Asset Managers). Will the new administration’s push for deregulation provide an opportunity for a new start?

Whereas there is seldom any debate in Europe as to whether ESG is appropriate from a fiduciary perspective, the US business culture is different, profit maximisation is paramount, and investors do not necessarily see ESG factors as material, hence not worth considering. But one can also say that as long as you make a case that taking ESG into consideration enhances risk-adjusted returns, it will be relevant.

The appointment of the new SEC Chairman and how this impacts disclosure regulations will be worth watching and should give a sense of where the wind is blowing. Will the new US administration further contest the implementation of the SEC’s new climate change disclosure rules, which were initially set for 2025? This was extensively discussed during a recent ESG roundtable we joined in Hong Kong, invited as a speaker by China Association for Public Companies.

The US stepping back in this area provides an opportunity for others to take leadership in international rulemaking, and regardless of what happens at the federal level, some states, and particularly California (if it were a country, its USD 4 trillion economy would rank between Germany and Japan), are expected to intensify disclosure efforts, requiring disclosure of scope 1, 2, and 3 emissions, climate-related risks and offsetting.

Who will take the baton in the climate relay race?

In conclusion, even if we are running out of time for the Agenda 2030, there are reasons to remain cautiously optimistic. A pragmatic Trump, whose most important objectives are to cut tax and create jobs, could change his mind; and the energy and climate agenda is not only decided upon in the Oval office. There are other driving forces behind the US energy transition, such as the power-hungry AI-boom, the economics of renewable energy, and non-federal decision-makers.

Besides, even if Trump's likely policies risk slow down decarbonization in the US, it won’t slow it down elsewhere. Most emerging and frontier markets have domestic driven economies looking for cheaper sources of energy and clean energy technologies will continue to outcompete fossil fuels.

So let’s remain optimistic that a “less green White House” might act as a catalyst for global climate action. As shortly there will no longer be an apparent contradiction between being the leading oil exporter and a climate leader, it might be the wake-up call we need. Other countries will see this as an opportunity to take the baton and lead the race.